The Client is India’s leading investment bank and project advisor. It is registered with SEBI as a category I Merchant Banker and a Research Analyst. Incorporated in 1986, it is one of the oldest investment banks in India, dominating the Indian investment banking landscape for over 35 years. They offer a complete solution by providing their clients with diversified corporate advisory and investment banking services, innovative ideas, and unparalleled execution.

As a Banking and Investment firm, it is required to maintain frequent and real-time communication between multi-located branch offices as well as customers. With multi-located branch offices, communication can prove to be a costly affair, if communication devices are not chosen wisely. Apart from cost-related challenges, they faced technical challenges with analog terminals, like access to IP-based features. The devices already in use incurred recurring costs and lacked advanced features.

To elaborate:

- Recurring Expenses: Licenses acquired through a subscription-based model proved to be costly and recurring.

- Redundancy: Seamless communication is only possible if there is Active-Active redundancy (both servers keep running in parallel and the system stops only if both servers stop functioning) which was lagging, in this case.

- Outdated Phone Features: The lack of advanced features like Abbreviated Dialing, Call Pick Up, and Internal Call Restriction, prevented them from becoming efficient in day-to-day operations.

- Centralized Management: The absence of arrangements to manage multi-located offices from a single location.

Matrix analyzed the challenges of the investment bank and crafted a multilocation communication solution that was the best fit. The solution offered included the Matrix range of products that saved cost and helped the firm become more efficient.

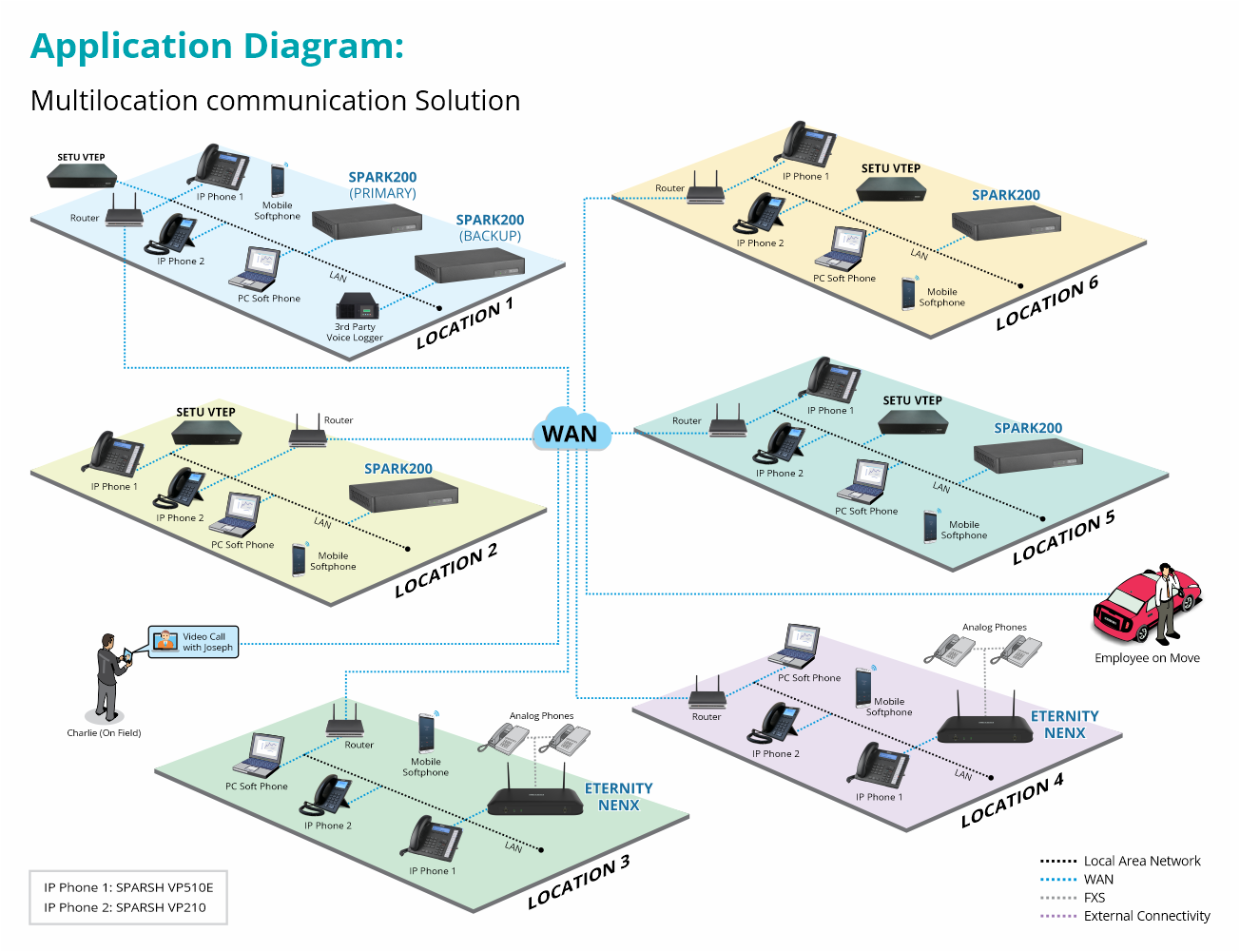

The multilocation communication Solution provided can be summarised as under:

- At Location 1, the SETU VTEP 1P VoIP-PRI gateway converts a PRI line to an IP network, linking the Embedded IP-PBX, PRASAR UCS – SPARK200. This network connects IP phones and UC Clients locally and across branches via WAN. Location 1 also boasts redundancy with a backup PRASAR UCS system.

- At locations 2, 5, and 6, the SETU VTEP 1P VoIP-PRI gateway converts a PRI line to an IP network, linking the Embedded IP-PBX, PRASAR UCS – SPARK200. Through WAN, the router facilitates IP connectivity to PRASAR UCS which through LAN enables connectivity between IP Phones and UC Clients within and among locations 2, 5, and 6.

- At locations 3 and 4, the router enables IP connectivity to the hybrid PBX, ETERNITY NENX, via WAN. This system supports Analog phones alongside IP phones and UC clients through LAN.

The multilocation communication solution so implemented proved beneficial for the investment bank in more than one way.

- The VOIP-PRI gateway, SETU VTEP, provided much-needed least-cost routing ensuring that the call is always placed on the most appropriate network resulting in the least possible call cost

- PRASAR UCS as a pure IP solution, provided the feature of Active-Active redundancy to ensure uninterrupted operations. It sufficed the much-needed – Collaboration, Communication, Messaging, and Mobility.

- The IP desk phones helped provide advanced features like Call Pick up, Call Forward, Call Waiting, and Call Transfer along with an Intuitive interface, that enabled employees to become efficient as well as enhance user experience.

- With Centralized Management Server – PRAMAN CMS100, central management of all telecom devices located across multiple offices helped reduce manpower and eased data maintenance and related costs.

The multilocation communication solution enables the client to attain the overall objective of seamless collaboration between its multilocated sites in addition to enhancing its communication efficiency.

- Matrix ETERNITY NENXIP50: Hybrid PBX

- Matrix PRASAR UCS – SPARK200: Embedded IP PBX Server

- Matrix SETU VTEP 1P/2P: VoIP – PRI Gateway

- Matrix SPARSH VP210 – Entry-Level Gigabit IP Phone

- Matrix SPARSH VP510E – Premium Standard SIP Phone